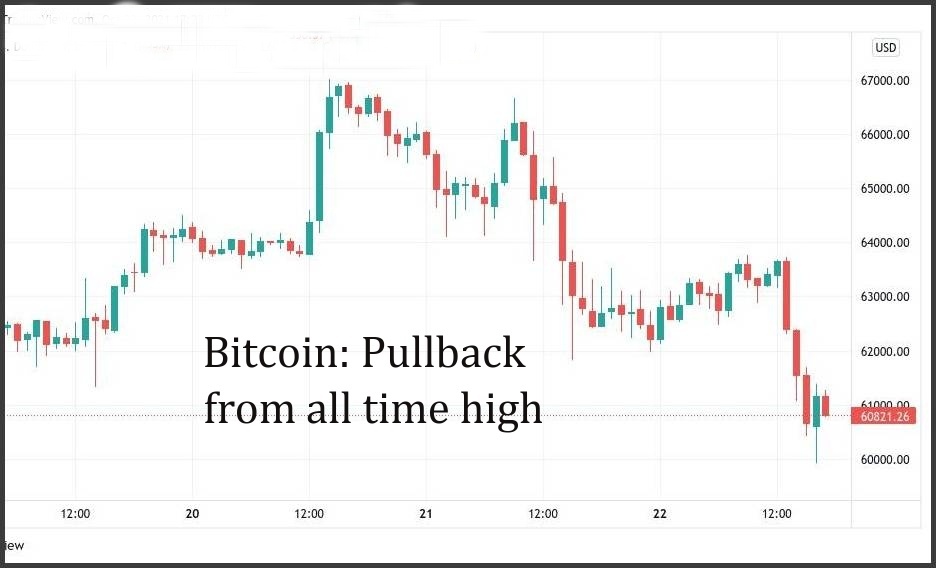

Bitcoin plunged below $60,000 after crypto markets hit record highs earlier in the week. Concerns about the strength of the market arose as the Bitcoin (BTC) price hit all-time highs, seeing a correction on October 22, briefly dropping below $60,000.

According to data from Cointelegraph Markets and TradingView, the BTC/USD pair fell 6 percent on the Bitstamp exchange to $59,930 during the day. After the recovery, the pair rallied above $60,000, but this week also signals the importance of being cautious.

Michaël van de Poppe, a contributor to Cointelegraph, said, “I was watching $64k as a crucial level to be crossed, but the market has failed, so corrective action is taking place.”

“Overall, it might be a good level to buy Bitcoin at $56 to $59k.”

The previous all-time high of $64,900 acted as support for little time rather than a recurring resistance zone as the bulls had little chance of securing gains.

As usual, optimism is felt only among those who take a long-term view of the market. Among them is popular Twitter analyst TechDev, who emphasized that 2021 still aligns with historical bull market trends.

“Looking at the eternal BTC trend, mid-cycle ALWAYS 5 degrees steeper than the move to the top,” he said, along with a comparative chart.

“Correct so far. If it continues, the 228 to 250k range can be reached (the 2nd most reliable historically Fibonacci-based target)… It can be expected by the end of January. It will be interesting to follow.”

Bitcoin thus left the focus of attention to altcoins in shorter timeframes, while the top twenty cryptocurrencies by market capitalization increased, Solana (SOL), which achieved a 13 percent increase in 24 hours, is at the forefront.

Fresh out of a failed attempt to break all-time highs, Ether (ETH) slumped below $4,000 after a brief recovery. Bitcoin’s dominance remained at 45.7 percent, reflecting a shift of money to altcoins.

Meanwhile, as Cointelegraph previously reported, October’s “worst case scenario” marks a monthly close of $63,000 for the BTC/USD pair.

Visits: 84