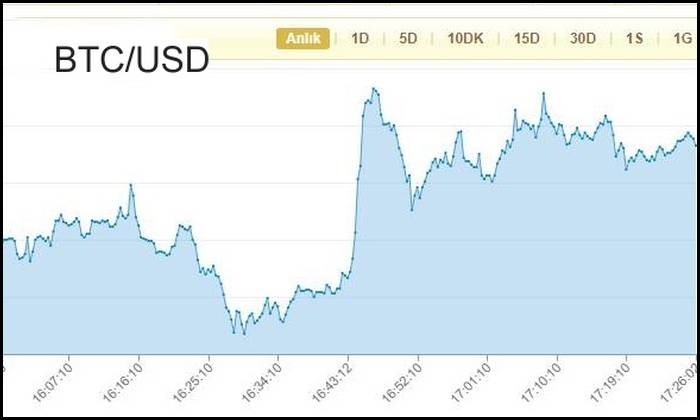

Bitcoin, which is horizontal in the morning hours, is priced at $ 33,125. Among the macro developments expected today, while the US core inflation is expected to rise from 3.8% to 4%, in case of data above expectations, it may create a selling pressure on the market as it may create a perception that monetary expansion will end earlier.

The fact that there is no news about the decline in crypto money exchanges that started as of yesterday may be creating selling pressure in crypto money exchanges and especially Bitcoin due to the expected inflation data in global markets. In addition, when we consider the Bitcoin chain data, we interpret the increase in the number of active and new addresses in the last 24 hours positively.

When we consider the BTC/USDT parity technically, for Bitcoin, which opens daily below the weekly DEMA level of $ 33,269, if these levels are broken on the upside, the price can move towards $ 34,838. If the selling pressure continues in the market and the price action is to the downside, the closest support level will be the monthly DEMA ($32,379) levels. In the short term, buying near support and selling near resistance will be a more appropriate strategy.

BTC/USDT

Pivot: 33,340

Resistors

34.030 / 35.190 / 35.880

Supports

32.180 / 31.490 / 30.330

Visits: 62