The Bank for International Settlements (BIS), a global financial institution that includes some of the world’s largest central banks, rejects the theory that cryptocurrency ownership is linked to distrust in traditional finance.

On Thursday, the BIS published an article on the socioeconomic structures of cryptocurrency investments in the United States. Using representative data from the US Consumer Payment Preference Survey, the BIS argued that distrust in fiat currencies like the US dollar has nothing to do with investor motivation to hold cryptocurrencies like Bitcoin (BTC):

“Demand for cryptocurrencies is not driven by insecurity in cash or the financial sector, given that there is no difference in the perceived safety of cash, offline and online banking. Hence, we hypothesize that cryptocurrencies are sought as an alternative to fiat currencies or regulated financing. We can refute it.”

The official stressed that cryptocurrencies are not sought as alternatives to fiat currencies or regulated finance, but rather are a “niche digital speculation object”. The BIS noted that from a policy perspective, the overall implication of the analysis is that investors’ goals are “the same as for other asset classes, so regulation should be created similarly.”

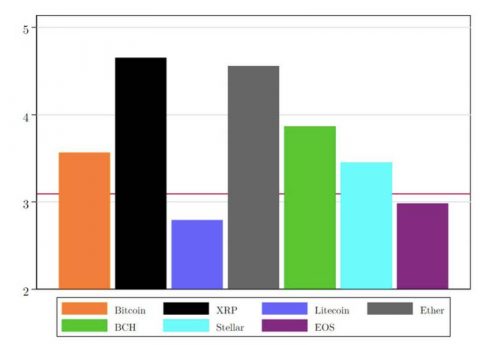

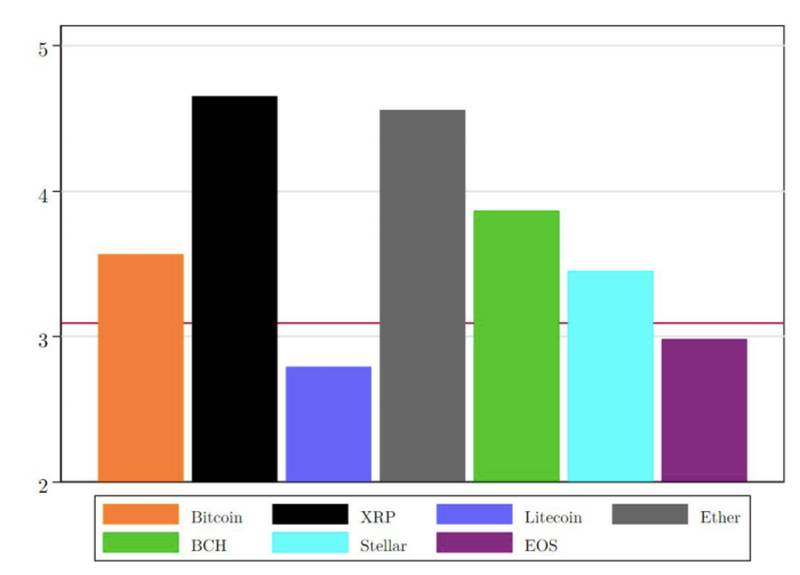

The BIS report also outlines the main correlations between cryptocurrency investment preferences and education and income level, suggesting that cryptocurrency holders are “more educated than average in general.” Ether (ETH) and XRP investors showed the highest level of education in the BIS analysis, while Litecoin (LTC) holders were the least educated, while Bitcoin holders ranked in the middle.

The report suggests that it poses no threat to traditional financial instruments as its demand for cryptocurrencies such as Bitcoin is not driven by insecurity in cash. A number of global authorities and institutions have previously expressed concerns about Bitcoin’s ability to capitalize on global distrust in traditional finance.

In late December, Ruchir Sharma of Morgan Stanley Investment argued that the reign of the US dollar would end due to global distrust in traditional finance and that Bitcoin would benefit from this lack of confidence.

Visits: 81