Both crypto influencers and crypto analysts are literally split on the direction of Bitcoin. Let’s categorize these views and take a closer look. Some of those who believe that the rise will continue have tied it to the condition that BTC exceeds a certain level. Those who say 40 thousand if they break $38K up are on the one hand, those who say $40K if they do not break $36K down, on the other. At least they have $40K in common.

There is no “but” for this segment. This segment believes that the declines mean nothing and that Bitcoin will rise to between $39K and $41K in one way or another. This segment believes that the bear market has started in Bitcoin and that this decline is the way to $25K.

On the other hand, although Bitcoin is the largest cryptocurrency in terms of portfolio size, it is not so in terms of the number of investors. Considering that there are more than 10.000 altcoins, the most curious question these days is what will be the altcoins rather than Bitcoin.

As such, it is another problem to analyze altcoins one by one and write and draw the same scenarios for each. That’s why everyone’s trouble these days is the direction of Bitcoin, which is considered the honor of the cryptocurrency markets. The assumption that if BTC will rise, altcoins will eventually rise, is the most important reason for this anxiety.

Is it really like that? For a long time, the view was that there was a correlation between altcoins and the price of Bitcoin. But for about two years, this urban legend has been debunked, at least in terms of one-to-one correlation.

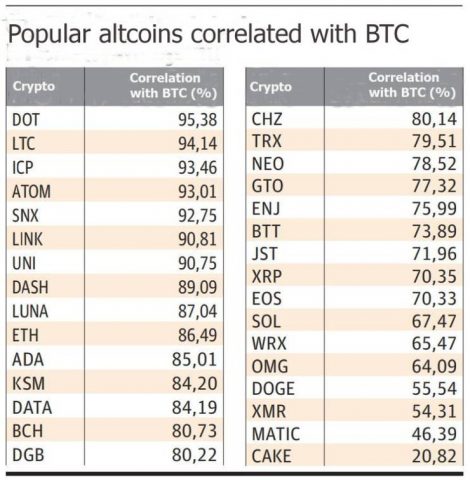

The strongest and weakest altcoins correlated with Bitcoin

We also found a correlation by comparing the price movements of the highest market value altcoins with BTC for the last 1 year. Among the 32 altcoins we examined, Polkadot (DOT) has the most correlation with Bitcoin. The correlation between Polkadot and BTC is 0.95. So it means that 95 out of every 100 rises of Bitcoin are accompanied by Polkadot. It is followed by LTC with 94 percent and ICP with 93 percent.

The weakest correlation with Bitcoin is Pancake Swap (CAKE). It almost accompanies only 1 out of every 5 rises of Bitcoin. Again, MATIC and XMR with weak correlations can be counted. These correlation coefficients are actually an indicator that can be easily used during Bitcoin’s main trends.

It may be logical to consider those with weak correlations during Bitcoin’s downtrend, and high ones during Bitcoin’s bull runs. After all, most of these altcoins are reacting more aggressively to Bitcoin’s movements. This is both a risk and an opportunity.

Visits: 89