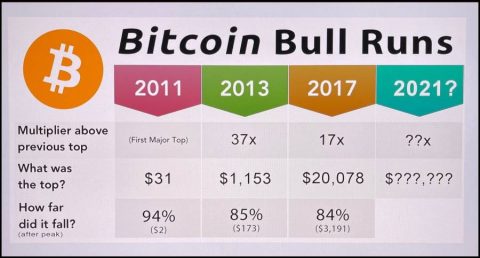

It is possible to predict forward by examining the bull cycles experienced in Bitcoin. When reviewing these analyses, keep in mind that purely technical similarities are taken into account and estimates may be wrong due to different fundamental dynamics in a bull run.

In previous bull cycles, we mentioned that the daily MA 50 is an important level and the downtrend will continue as long as we stay below this level. When we wrote the related news, Bitcoin was at $50K.

There is another level as important as the daily MA50 in Bitcoin cycles. This is the Weekly MA20. On the charts, we see the weekly MA20 movement in Bitcoin’s 2013-2014 and 2017-2018 rallies, respectively.

At this point, we come across data that will please the investors who are on the opposite side. After all the bull runs, Bitcoin does not enter the bear season without retesting the weekly MA20. So even in the worst case scenario, we can see that Bitcoin is testing the $48K levels again (it may change over time).

We do not know which one will be tested first in Bitcoin, which is currently between the weekly MA20 and MA50. We see that we are approaching the MA50 in the form of a needle twice. Buyer pressure in this region may not have allowed the MA50 to be fully tested. Assuming the MA50 is tested with the pins appearing, it looks like the Weekly MA20 is testing next. The weekly MA50 is crossing the $29400 levels. Note that these levels may change at each weekly close.

If the Weekly MA20 breaks to the upside again and we manage to stay above it, we could see the start of a new bull cycle in Bitcoin that will bring the $100K target. If we get rejection from the weekly MA20, we can see a new downward wave towards other averages.

Visits: 67